HOW CUVO WORKS

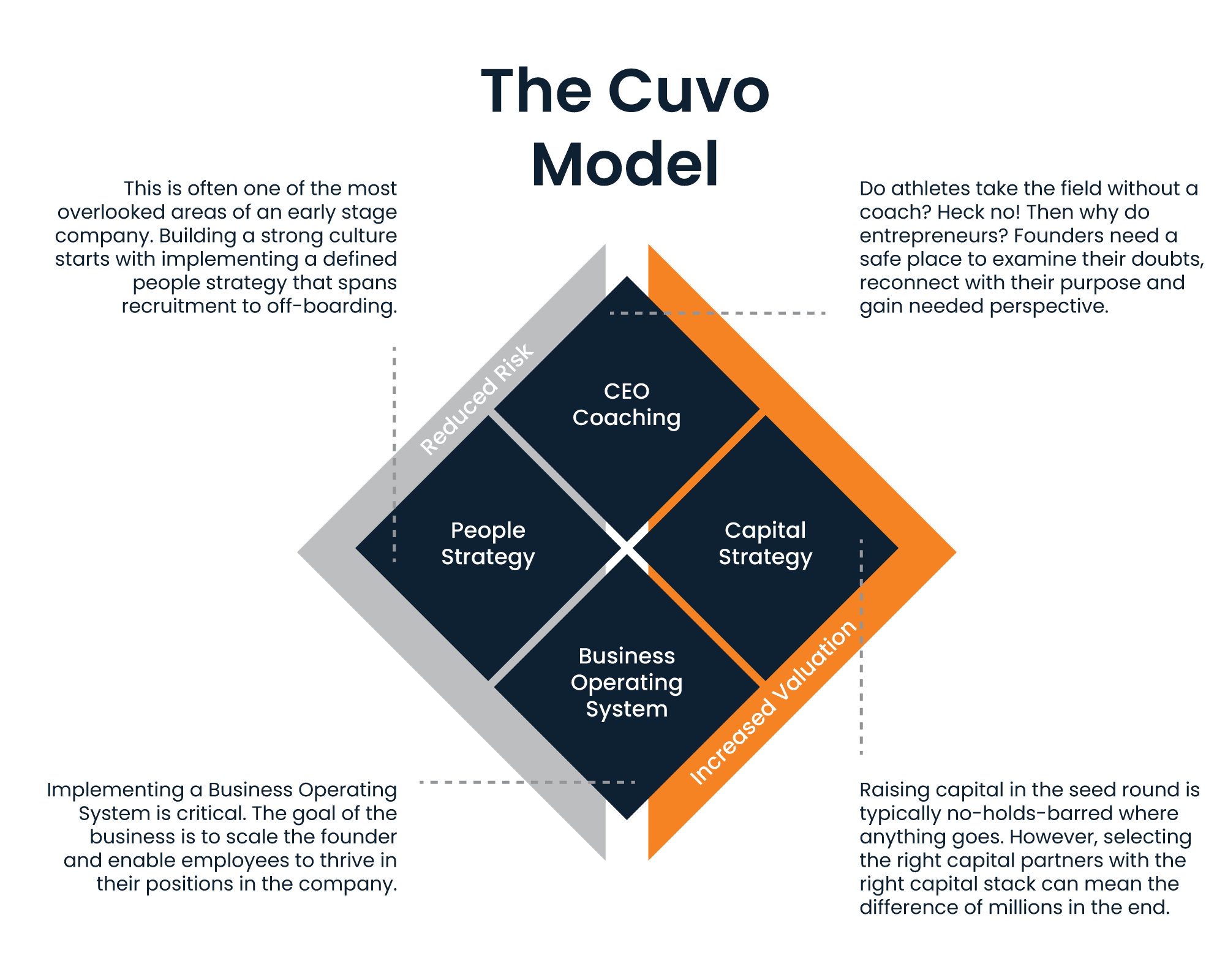

We partner with early stage companies to implement a proven playbook that reduces risk and increases valuation.

Reduce risk

No one needs to tell you that risk is prevalent in early stage companies. We help by teaching a proven way to operate the company, building a people strategy that creates an unstoppable culture and coaching the founder(s) to be his/her best.

Increase valuation

Let’s face it: Valuation matters. And the factors that drive valuation really matter. We help by guiding a capitalization strategy, ensuring smooth due diligence processes and helping the leadership team execute the vision. Think of us as partners in crime.

We know it’s lonely at the top. That’s why every CEO needs a safe place to examine their doubts, reconnect with their purpose and talk through problems in confidence. Go from great founder to great CEO.

→ Fully understand the CEO role

→ Build and motivate an effective leadership team

→ Take control of the calendar

→ Set expectations and manage performance

→ Drive urgency within the team

→ Balance long-term and short-term priorities

Every growth-oriented company must identify and operate on one “operating system.” It’s critical to form common language within the company so that everyone is rowing in the same direction with clarity.

→ Solve problems for good

→ Instill focus, discipline and accountability

→ No theory or management fads

→ Better vision and accountability

→ Become a more effective leadership team

→ Get everyone in the company rowing in one direction

Early stage companies need to approach their people strategy with as much dedication as they do their vision. Ambitions are off the charts and there aren’t enough hours in the day for the team.

→ Quantify and create an employee option pool

→ Master effective job descriptions

→ Learn tools to hire the RIGHT people

→ Implement easy review and feedback loops

→ Create impactful onboarding experiences

→ Foster and develop a healthy culture

Balancing the need for capital, finding the right capital partner to add strategic value and the securing the cheapest cost of capital is nothing short of a miracle.

→ Create a defined capital strategy for scale

→ Understand different sources of financing

→ Identify value add investors

→ Create sophisticated financial projections

→ How to time the Series A

→ Audit current financial controls